Buying and selling goods in the international trade system can often be complicated with responsibilities, cost and risk to all parties needing to be determined.

To help you in the import and export of trade, the International Chamber of Commerce (ICC) introduced the International Commercial Terms (Incoterms®), which act as the world’s essential terms of trade for the sale of goods. Whether you are completing a purchase order, packaging and labelling a shipment, or preparing a certificate of origin, these regulations have become part of our daily language of trade and are there to guide you.

Since the first publication of the rules in 1936, the ICC has been maintaining and developing them ever since. To help prepare businesses for the next century of global trade, the newest edition, Incoterms® 2020, came into effect on 1 January 2020 and should be referenced going forward.

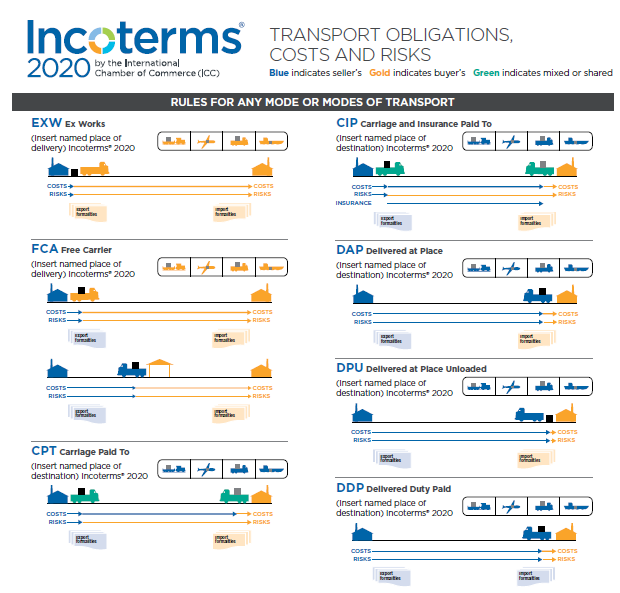

The Incoterms® rules feature a series of three-letter trade terms which all have very precise meanings for the sale of goods around the world.

The Incoterms® selected by our customers determine responsibilty between buyer and seller for VAT and duty payment, completion of required documentation and arranging transportation.

Rules for any mode or modes of transport:

Download here the official Incoterms wallchart

EXW – Ex Works (named place of delivery)

The seller makes the goods available at their premises, or at another named place. This term places the maximum obligation on the buyer and minimum obligations on the seller. The Ex Works term is often used while making an initial quotation for the sale of goods without any costs included.

EXW means that a buyer incurs the risks for bringing the goods to their final destination. Either the seller does not load the goods on collecting vehicles and does not clear them for export, or if the seller does load the goods, they do so at buyer's risk and cost. If the parties agree that the seller should be responsible for the loading of the goods on departure and to bear the risk and all costs of such loading, this must be made clear by adding explicit wording to this effect in the contract of sale.

There is no obligation for the seller to make a contract of carriage, but there is also no obligation for the buyer to arrange one either - the buyer may sell the goods on to their own customer for collection from the original seller's warehouse. However, in common practice the buyer arranges the collection of the freight from the designated location, and is responsible for clearing the goods through Customs. The buyer is also responsible for completing all the export documentation, although the seller does have an obligation to obtain information and documents at the buyer's request and cost.

These documentary requirements may result in two principal issues.

-

Firstly, the stipulation for the buyer to complete the export declaration can be an issue in certain jurisdictions (not least the European Union) where the customs regulations require the declarant to be either an individual or corporation resident within the jurisdiction. If the buyer is based outside of the customs jurisdiction they will be unable to clear the goods for export, meaning that the goods may be declared in the name of the seller by the buyer, even though the export formalities are the buyer's responsibility under the EXW term.

-

Secondly, most jurisdictions require companies to provide proof of export for tax purposes. In an EXW shipment, the buyer is under no obligation to provide such proof to the seller, or indeed to even export the goods. In a customs jurisdiction such as the European Union, this would leave the seller liable to a sales tax bill as if the goods were sold to a domestic customer. It is therefore of utmost importance that these matters are discussed with the buyer before the contract is agreed. It may well be that another Incoterm, such as FCA seller's premises, may be more suitable, since this puts the onus for declaring the goods for export onto the seller, which provides for more control over the export process.

FCA – Free Carrier (named place of delivery)

FCA can have two different meanings, each with varying levels of risk and cost for the buyer and seller. FCA (a) is used when the seller delivers the goods, cleared for export, at a named place which is their own premises. FCA (b) is used when the seller delivers the goods, cleared for export, at a named place which is not their premises. In both instances, the goods can be delivered to a carrier nominated by the buyer, or to another party nominated by the buyer.

In many respects this Incoterm has replaced FOB in modern usage, although the critical point at which the risk passes moves from loading aboard the vessel to the named place. The chosen place of delivery affects the obligations of loading and unloading the goods at that place.

If delivery occurs at the seller's premises, or at any other location that is under the seller's control, the seller is responsible for loading the goods on to the buyer's carrier. However, if delivery occurs at any other place, the seller is deemed to have delivered the goods once their transport has arrived at the named place; the buyer is responsible for both unloading the goods and loading them onto their own carrier.

CPT – Carriage Paid To (named place of destination)

CPT replaces the C&F (cost and freight) and CFR terms for all shipping modes outside of non-containerized seafreight.

Under CPT the seller pays for the carriage of goods up to the named place of destination.

However, the goods are considered to be delivered when the goods have been handed over to the first or main carrier, so that the risk transfers to buyer upon handing goods over to that carrier at the place of shipment in the country of Export.

The seller is responsible for origin costs including export clearance and freight costs for carriage to the named place of destination (either the final destination such as the buyer's facilities or a port of destination. This has to be agreed to by seller and buyer, however).

If the buyer requires the seller to obtain insurance, the Incoterm CIP should be considered instead.

CIP – Carriage and Insurance Paid to (named place of destination)

Similar to CPT with the exception that the seller is required to obtain minimum insurance for the goods while in transit.

DAP – Delivered at Place (named place of destination)

The seller is deemed to have delivered when the goods are placed at the disposal of the buyer on the arriving means of transport and ready for unloading at the named place of destination.

Under DAP terms, the risk passes from seller to buyer from the point of destination mentioned in the contract of delivery.

Once goods are ready for shipment, the necessary packing is carried out by the seller at their own cost, so that the goods reach their final destination safely. All necessary legal formalities in the exporting country are completed by the seller at their own cost and risk to clear the goods for export.

After arrival of the goods in the country of destination, the customs clearance in the importing country needs to be completed by the buyer, e.g. import permit, documents required by customs, etc., including all customs duties and taxes.

Under DAP terms, all carriage expenses with any terminal expenses are paid by seller up to the agreed destination point. The necessary unloading cost at final destination has to be borne by buyer under DAP terms.

DPU – Delivered at Place Unloaded (named place of destination)

This Incoterm requires that the seller delivers the goods, unloaded, at the named place. The seller covers all the costs of transport (export fees, carriage, unloading from main carrier at destination port and destination port charges) and assumes all risk until arrival at the destination place.

DDP – Delivered Duty Paid (named place of destination)

The seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination including import duties and taxes. The seller is not responsible for unloading. This term is often used in place of the non-Incoterm "Free In Store (FIS)". This term places the maximum obligations on the seller and minimum obligations on the buyer. No risk or responsibility is transferred to the buyer until delivery of the goods at the named place of destination.

The most important consideration for DDP terms is that the seller is responsible for clearing the goods through customs in the buyer's country, including both paying the duties and taxes, and obtaining the necessary authorizations and registrations from the authorities in that country. Unless the rules and regulations in the buyer's country are very well understood, DDP terms can be a very big risk both in terms of delays and in unforeseen extra costs, and should be used with caution.

Rules for sea and inland waterway transport:

Download here the official Incoterms wallchart

FAS – Free Alongside Ship (named port of shipment)

The seller delivers when the goods are placed alongside the vessel (e.g., on a quay or a barge) nominated by the buyer at the named port of shipment. The risk of loss of or damage to the goods passes when the goods are alongside the ship, and the buyer takes on responsibility for all costs from that moment onwards.

FOB – Free on Board

The seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel, and the buyer takes on responsibility for all costs from that moment onwards.

CFR – Cost and Freight

The seller delivers the goods on board the vessel. The risk of loss of or damage to the goods passes when the goods are on board the vessel. The seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination.

CIF – Cost, Insurance and Freight

The same as CFR with the addition that the seller must also obtain minimum insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage.

Differences between Incoterms® 2010 and 2020:

-

The Incoterms® FCA (Free Carrier) now provides the additional option to make an on-board notation on the Bill of Lading prior loading of the goods on a vessel.

-

The costs now appear centralized in A9/B9 of each Incoterms® rule.

-

CIP now requires at least an insurance with the minimum cover of the Institute Cargo Clause (A) (All risk, subject to itemized exclusions).

-

CIF requires at least an insurance with the minimum cover of the Institute Cargo Clause (C) (Number of listed risks, subject to itemized exclusions).

-

The Incoterms® rules Free Carrier (FCA), Delivered at Place (DAP), Delivered at Place Unloaded (DPU) and Delivered Duty Paid (DDP) now take into account that the goods may be carried without any third-party carrier being engaged, namely by using its own means of transportation.

-

The rule Delivered at Terminal (DAT) has been changed to Delivered at Place Unloaded (DPU) to clarify that the place of destination could be any place and not only a “terminal”.

-

The Incoterms® 2020 now explicitly shifts the responsibility of security-related requirements and ancillary costs to the seller.

Useful information

The Incoterms® do not constitute a complete contract of sale, but rather become a part of it. For its application, the following structure should be used:

“[The chosen Incoterm® rule] [Named port, place or point] Incoterms® 2020”

Example: “CIF Shanghai Incoterms® 2020” or “DAP 10 Downing Street, London, Great Britain Incoterms® 2020“

If there is no year stated in the Incoterms® then the following applies:

until December 31st 2019 the Incoterms® 2010 apply.

from January 1st 2020 the Incoterms® 2020 apply.

If a different year is stated, e. g. Incoterms® 1980, then respective terms apply.

For more details, please refer to the ICC official website: https://iccwbo.org.

.png/a133cc44-7f5e-23fc-1e92-93a12752cf7a)